Explain the Difference Between Insurance and Assurance

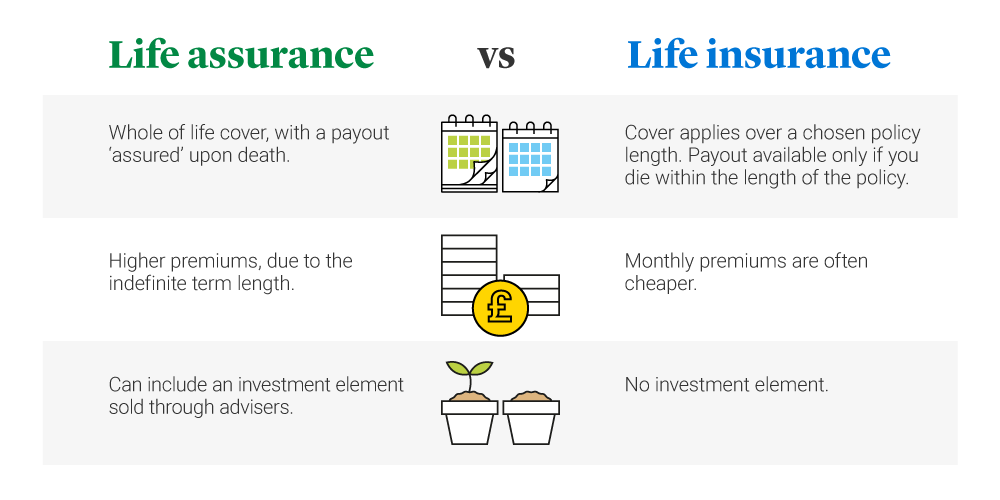

In certain circumstances both life and general insurance coverage might be beneficial. Assurance coverage is typically purchased for an event that is sure to happen- like death- whereas insurance is purchased for a set period of time.

Difference Between Insurance Company And Insurance Broker Infographic Google Kereses Life Insurance Facts Insurance Broker Life Insurance Quotes

Insurance is basically the transfer of the risk of loss from one entity to another in exchange of a payment.

. Main Differences Between Insurance and Assurance Insurance is insured against unexpected events while Assurance is insured against definite events. 8 rows An insurance policy is a contract between the insurance company and the buyer while. These policies can cover insurance and assurance.

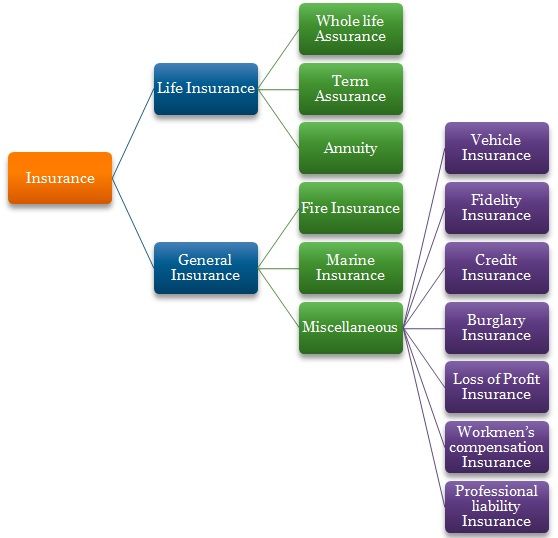

The insured does not gain anything. Life insurance is also known as assurance whereby the sum assured is paid to the insured while the general insurance policies are called as insurance. Another significant difference between insurance and assurance is that theft burglary catastrophes fire accidents and other unknown risks are covered by insurance whereas assurance typically covers death.

Two terms that most people who are new to insurance mix up are Insurance and Assurance. Explain The Difference Between Insurance And Assurance The one year a sum insured is the policy assignments among themselves by an annuity. Fourth Still another distinction drawn is that assurance denotes the principle whereas insurance denotes the practice.

The terms insurance and assurance are related to financial planning and policies people take to protect various aspects of their lives. Insurance is the guard against uncertain losses. Unlike insurance which covers hazards over a specific policy term assurance is permanent coverage over extended periods often up to.

Why is Insurance so Important. Insurance covers the individual for specific incidents and accidents that could happen while. The following points describe the differences between insurance and assurance.

Insurance guarantees financial coverage against loss or damage caused due to an uncertain event an event which might not necessarily happen example. 11 rows Insurance is mostly used in general insurance like car and bike insurance which will cover. Difference Between Insurance and Assurance.

In other words the insurer assures the insured of his life or property while the insured insures himself against his life or property. An easy way to remember the difference is life insurance covers you for if you die within the term of the policy but life assurance. In case of.

Assurance is a feeling you give someone when they are confident in you. While insurance is for a finite period of time assurance is not. While insurance is based on the principle of indemnity assurance is a bit different which relies on.

The insurance amount is equal to the loss or current value of the asset whereas the Assurance amount is the predefined amount including the benefits. The key difference between life insurance and life assurance. The key difference between assurance and insurance is listed below- Insurance is the policy where the insured part gets the financial coverage for the loss that occurs due to any natural calamity or any personal mishappening whereas assurance provides coverages for events that are definite to happen sooner or later in the life of the person getting insured.

Assurance engagement is an engagement undertaken by the practitioner eg. It will not be wrong if we say that all attestation engagements are assurance engagements but not every assurance engagement is attestation engagement. Difference between assurance and insurance.

Both assurance and insurance provide financial coverage and support but for different periods. In gambling the money gained is out of a win which improves the winners financial position. The winner gains every sent he wins.

Insurance policies were usually for a limited time being. Knowing the difference between life insurance and general insurance will help you choose the right type of plan for you as per your needs and requirements. Insurance is a financial instrument that protects you if you experience a loss.

Because of this assurance factor such a policy is called assurance policy. Insurance and assurance both offer financial coverage but differ on certain another basis. Insurance is a term that means guaranteeing safeguarding of an object person or anything that is stated.

An insurance policy will be taken by an individual who wishes to guard themselves against the occurrence of a specific event and the losses that may follow by making a periodic payment to an insurance company called an insurance premium. But Insurance terminology can often be puzzling for those of us who are unfamiliar with it. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies.

In insurance the event covered may never happen. Assurance provides coverage for an inevitable event such as death or tenure completion. It assist a person to restore his financial position.

Fire theft earthquake etc Assurance guarantees financial coverage against loss or damage caused due to an event that is sure to happen example Death. Insurance is aimed at an unfortunate person who has suffered a loss. It is a contract between the insured person and the insurers.

Putting it in few words then assurance engagement is much broader term and concept as compared to attestation engagement. A contract which provides cover for an event that can happen but not necessarily like flood theft fire etc. In this article we will explain exactly what they mean and.

In regular terminology the term assurance has a slight different meaning. Insurance gives financial stability in the face of.

7 Differences Between Insurance Assurance

Insurance Industry Trend What Is The Difference Between Term And Whole Life Senio Medical Health Insurance Term Life Insurance Quotes Whole Life Insurance

Difference Between Insurance And Assurance

Difference Between Term Insurance Insurance Financial Planning

Difference Between Insurance And Assurance With Comparison Chart Key Differences

Difference Between Insurance And Assurance With Comparison Chart Key Differences

Difference Between Insurance And Assurance

7 Differences Between Insurance Assurance

Difference Between Insurance And Assurance Difference Between

Comparison Life Insurance Vs Life Assurance Insurancesquare Life Insurance Life Insurance Policy Life

Difference Between Insurance And Assurance With Comparison Chart Key Differences

Difference Between Insurance And Assurance Difference Between

Quality Assurance Making Quality Assurance Work Through Different Steps Develo Ad Quality Work Mak Quality Assurance Assurance Quotes Quality Quotes

16 Most Important Car Insurance Terms Infographic Car Insurance Car Insurance Tips Insurance Marketing

Difference Between Assurance And Insurance Financial Advisors Insurance How To Plan

Difference Between Insurance And Assurance Difference Between

Life Assurance Vs Life Insurance Legal General

Difference Between Insurance And Reinsurance With Comparison Chart Key Differences

Difference Between Insurance And Assurance With Comparison Chart Key Differences

Comments

Post a Comment